Visit our overview page for more information on wire transfers. International wires may take 3–5 business days to arrive and be deposited to your account. The following account types are charged a $15 fee for incoming wire transfers:Īll other account types are not charged a fee.ĭomestic transfers will be deposited and made available the same business day if received by 5 p.m. Please call for help with your routing number.įees for receiving a wire transfer vary by account type. If you’re not enrolled in digital banking, your account number can be found at the top of your paper statement.

Your Capital One account and routing numbers.Capital One’s address: 1680 Capital One Drive McLean, VA 22102-3491.

#BANK OF AMERICA INCOMING WIRE ROUTING NUMBER CALIFORNIA CODE#

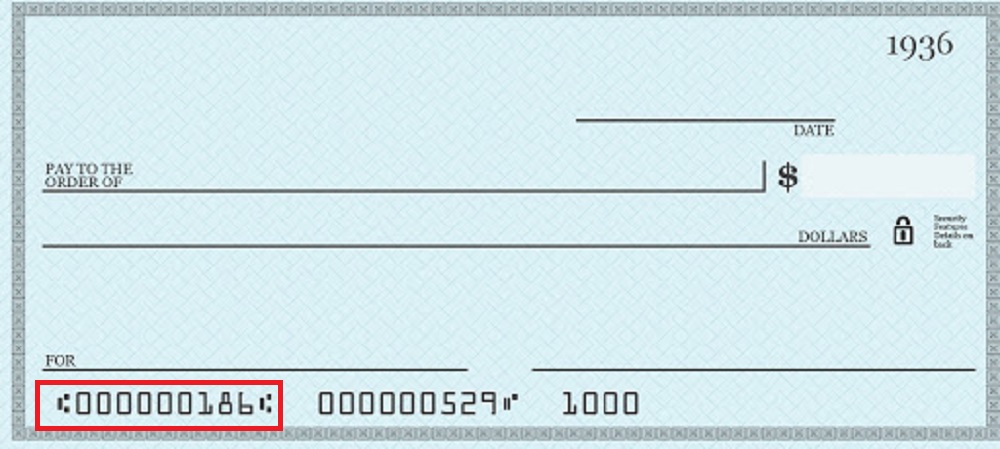

Capital One’s swift code (IBAN): HIBKUS44.You may need to provide the sending bank the following information: The wire transfers process for small business and commercial accounts may differ. Keep in mind, these steps apply to personal bank accounts. They’ll also be your point of contact for any questions or issues you may have. When you’re receiving a wire transfer, the sending bank will be fully responsible for initiating the transfer. If it’s requested after this time, it will be delivered the next business day. The money will be delivered the same day, if requested by 2 p.m ET. When the money will get to your recipient Intermediary bank wire routing number (ABA)įor more information regarding sending eligibility, please visit our support page.Title company bank’s wire routing number (ABA).You will need your mobile phone in order to authenticate. The wire transfer process for small business and commercial accounts may differ.īelow you can find the information you will need to send a wire transfer online. Keep in mind that these steps apply to personal bank accounts. See our support page for more information on requirements for wire transfers. Please provide the sending financial institution with the American Eagle FCU Routing 211176891 and address, your account number, and the account type (. There is a $30 sender fee for all online wire transfers. If youre reordering checks, setting up a direct deposit or an automatic payment or preparing a wire transfer, youll probably be asked to provide an ABA routing number. Wire transfers allow you to send large amounts of money quickly and securely.

0 kommentar(er)

0 kommentar(er)